Child Tax Credit 2024 Eligibility Requirements Amount – The child you’re claiming the credit for was under the age of 17 on Dec. 31, 2023. which helped drive child poverty to a record low Jan. 29 According to a Washington Post report . The framework suggests increasing the maximum refundable portion of the CTC from the current $1,600 per child Tax Credit will build more than 200,000 new affordable housing units.” The changes .

Child Tax Credit 2024 Eligibility Requirements Amount

Source : www.investopedia.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : kvguruji.com

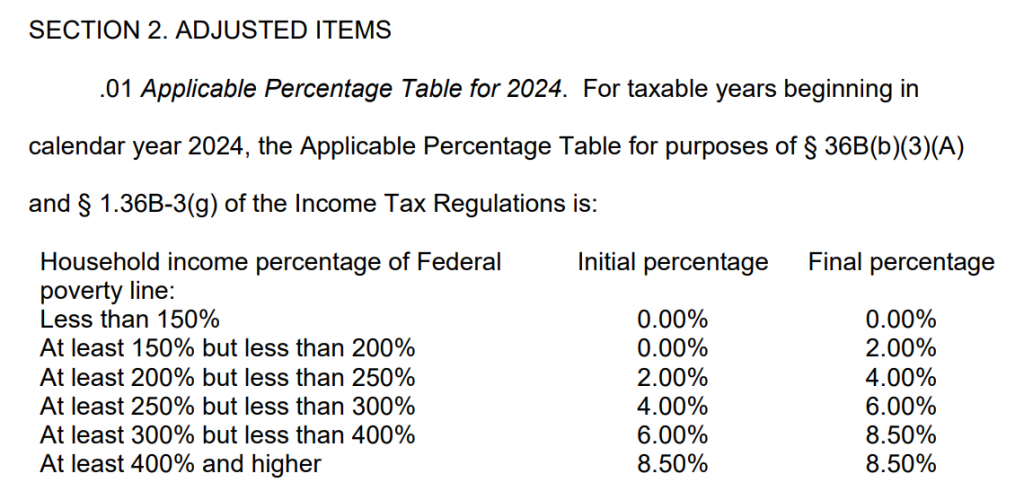

IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA

Source : www.cpapracticeadvisor.com

Child Tax Credit 2024 Apply Online, Eligibility Criteria

Source : matricbseb.com

Earned Income Tax Credit 2024 Eligibility, Amount & How to claim

Source : www.bscnursing2022.com

Child Tax Credit 2024: How Much You Could Get and Who’s Eligible

Source : www.cnet.com

Child Tax Credit Amount 2024 Eligibility, Claiming Deadline, How

Source : ncblpc.org

Every EV Qualified for U.S. Tax Credits in 2024

Source : www.visualcapitalist.com

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

Child Tax Credit 2024 Eligibility Requirements Amount Child Tax Credit Definition: How It Works and How to Claim It: Child Tax Credit 2024 Income Limits: A substantial federal tax benefit, the child tax credit is intended to provide financial assistance to American taxpayers who are in the process of rearing . Congress is hashing out a deal to improve the Child Tax Credit, possibly before the start of tax season. For now, these are the eligibility limits in 2024. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)